lincoln ne sales tax 2019

August 20 2019 lincoln neb Tax Commissioner Tony Fulton announced that the city of Lincoln will increase its local sales and use tax rate to 175 effective October 1 2019. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

10136 Queensland Rd West Des Moines Ia 50266 Mls 600593 Zillow Ranch Homes For Sale House Colors Hardy Plank Siding

2019 Tax Increment Financing Report for the City of Lincoln In March of 2018 Governor Ricketts signed into law an amendment to the Nebraska Community Development Law Neb.

. Lincoln on the Move. The group is asking the City Council to place on the April 9 primary ballot a measure to raise the City sales tax one-quarter cent for six years starting October 1 2019. 025 lower than the maximum sales tax in NE.

The Nebraska state sales and use tax rate is 55 055. Begin collecting sales taxes on candy pop bottled water plumbing services moving services and veterinary services for pets among others. There are no changes to local sales and use tax rates that are effective January 1 2022.

A no vote was a vote against authorizing the city to increase the local. Lincoln City-Lancaster County Planning Department Sales Tax Funds for New Street Construction Proposed Strategy August 26 2019 _____ The following is a proposed strategy from the Lincoln Transportation and Utilities Department and the Planning Department for use of the quarter cent sales for new street construction. The Nebraska sales tax rate is currently.

Supporters and opponents of a proposed quarter. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Supreme Court ruling that gave states the authority to.

2019 Review of. Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent ¼ upon the same transactions within such municipality on which the State of Nebraska is authorized to impose a tax for a period of six years for street. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton.

Seq which governs municipal tax increment. The decision follows a US. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements.

For tax rates in other cities see Kansas sales taxes by city and county. In Lincoln another 15 percent or one and a. Lincoln Countys median ratio was under 90 from 2015 2017.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

The December 2020 total local sales tax rate was also 7250. There is no applicable special tax. This is the total of state county and city sales tax rates.

It was approved. Nebraska News Online retailers to collect more sales tax in 2019. 1 the Village of Orchard will start a 15 local sales and use tax.

Prices exclude tax title and license and are valid for Washington residents only. The County sales tax rate is. Provided state school aid of 33 of total education costs per pupil to all schools.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. All transactions are negotiable including price trade allowance interest rate of which the dealer may retain a portion term and documentary service fee. The Lincoln sales tax rate is.

Additionally the village of Orchard will start a local sales and use tax at the rate of 15 effective October 1 2019. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. The sales tax jurisdiction name is Lincoln Center which may refer to a local government division.

There is no applicable county tax or special tax. Ballot Question April 9 2019. The sales tax increase.

You can print a 85 sales tax table here. 2019 Review of Property Tax Administration in Lincoln County. The Department of Revenue announced Friday that so-called remote sellers must obtain a sales tax permit and begin collecting the tax by Jan.

You can print a 725 sales tax table here. AP - Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate.

Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. Increased cigarette taxes 56 to 1pack. 2019 NA 822.

The 85 sales tax rate in Lincoln consists of 65 Kansas state sales tax 1 Lincoln County sales tax and 1 Lincoln tax. Property Tax Administration. Reports their yearly sales to the Department.

AP Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state. However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019. January 2 2019 507 am.

CITY OF LINCOLN City of Lincoln Ballot Question Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent 14 upon the same transactions within such municipality on which the State of Nebraska is authorized to impose a tax for a. For tax rates in other cities see Nebraska sales taxes by city and county. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019.

A car navigates around potholes this spring on Cornhusker Highway near 48th Street in March 2019. Raised the state sales tax rate from 55 to 625 a 14 increase. 2019 Lincoln MKC for Sale in Seattle WA - OfferUp.

Lincoln Ne Sales Tax Rate 2018 Agustus 05 2021 Dapatkan link. There are no changes to local sales and use tax rates that are effective July 1 2022.

Used One Owner 2019 Ford Mustang Revenge Gt Premium Near Canton Oh Sarchione Auto Group

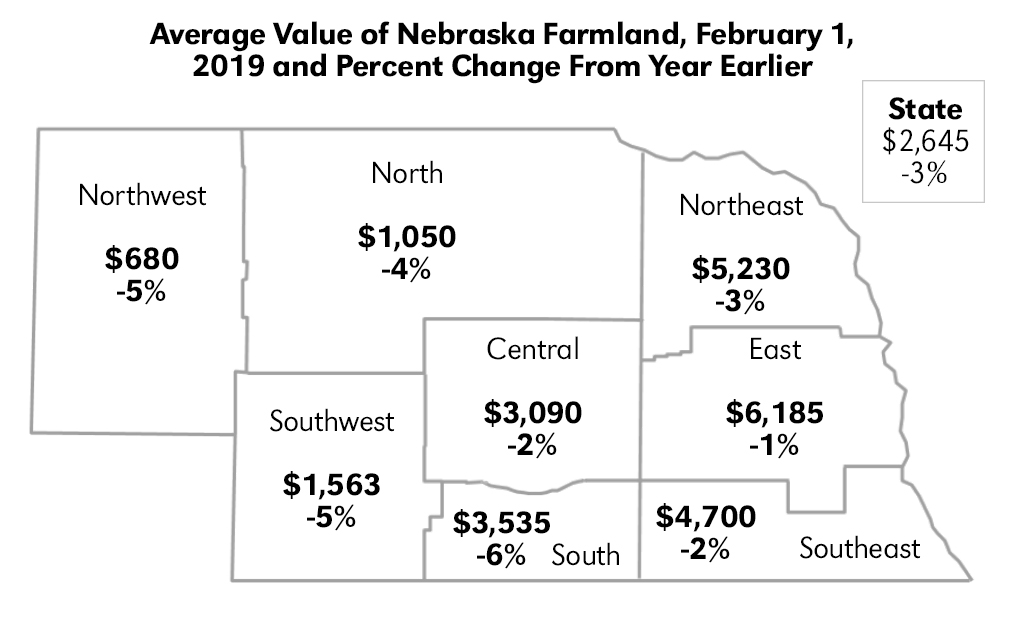

2019 Nebraska Property Tax Issues Agricultural Economics

Used 2019 Lincoln Mkc For Sale

Used 2019 Gmc Acadia For Sale Near Me Edmunds

Used 2019 Gmc Acadia For Sale Near Me Edmunds

Used Cars For Sale Bowling Green Ky Greenwood Ford

Certified Pre Owned 2019 Toyota Highlander Limited Sport Utility In Culver City T21050t Culver City Toyota

See This Home On Redfin 1743 Colfax St Blair Ne 68008 Mls 21911604 Foundonredfin Colfax House Prices Hardwood Bedroom Floors

Used 2019 Land Rover Range Rover Velar P380 R Dynamic Hse Awd For Sale With Photos Cargurus

Pre Owned 2019 Gmc Yukon Slt Sport Utility In Culver City T20284k Culver City Toyota

1206 E Military Ave Fremont Ne 68025 2 Beds 1 5 Baths Fremont House Prices Real Estate Sales

Vehicle And Boat Registration Renewal Nebraska Dmv

Used 2019 Lincoln Mkc For Sale

Pizza Ranch Guest Satisfaction Survey 2019 In 2021 Pizza Ranch Ranch Pizza Buffet

Today S Ljs Is The Last Edition Printed In Lincoln Endofanera Signsofprogress Instagram Prints Star Signs

2019 Nebraska Farm Real Estate Report Agricultural Economics